You tried ChatGPT for finance tasks. The results? Disappointing.

That’s not because the technology isn’t ready. It’s because the instructions weren’t. Most finance teams give up after their first attempts produce vague, inconsistent, or simply erroneous outputs.

The truth is, finance prompting isn’t like emailing a peer or brainstorming an internal deck. Sloppy prompts lead to responses that won’t clear the compliance, accuracy, and reliability bar required for finance operations.

Small changes in how you write those prompts make the difference between noise and results you can actually trust. This guide will show you how by giving you:

- The anatomy of a strong finance prompt, so you know exactly what to include

- Ready-to-use templates for core workflows like invoice processing and compliance checks

- Before-and-after fixes for the gaps that make AI outputs unreliable

- A foundation for bigger AI wins, from faster month-end close to smoother audits

Most teams stumble because they don’t know what “good” looks like. Before you can troubleshoot issues or adapt templates, you need a clear picture of the building blocks every finance prompt should have.

The anatomy of a finance prompt that works

If you’re getting vague, off-base, or flat-out wrong responses from your LLM of choice, you’re probably missing the mark with your prompts. A reliable finance prompt is not just a single instruction. It is a structured request with five essential components.

When you include all five, you get outputs that are accurate, auditable, and ready to plug into your finance processes.

The breakdown

| Component | Purpose | Example |

|---|---|---|

| Clear objective | Give AI a precise goal so the output is not vague or incomplete. | Review this invoice and determine if it complies with our standard payment terms. |

| Relevant context | Provide background, business rules, policies, and known exceptions to ensure accuracy. | Your job is to assess whether invoices are compliant with our payment policy, which requires net-30 terms with 2% early pay discount. Note that Acme Inc. is approved for net-45 and no discount. |

| Output format | Define the exact structure and format of outputs to get exactly what you need. | Respond exactly as follows: "[invoice number]; Status = ['Compliant'/'Not Compliant'/'Need more information']; Brief reasoning (1 sentence)" |

| Constraints | Set guardrails to prevent overreach and enforce compliance. | Do not approve payments over $10,000 without escalation. |

| Examples | Show what good and bad look like by including a few representative examples. | Review the attached examples of compliant and non-compliant invoices. Invoice 4567 is compliant, invoice 1234 is not. |

Putting it all together

Here is how the five components combine into a single, usable prompt:

“Review the attached invoice for compliance with our payment policy, which requires net-30 terms with a 2% early pay discount. Provide results in the following format: Compliance status | Issues found | Recommended action. Do not approve payments over $10,000 without escalation. Example of a compliant invoice: Vendor A, Invoice #4567, Net-30 with early pay discount applied.”

When written this way, you’re giving the LLM a clear objective, the right context, a structured format, guardrails to follow, and an example to model against.

Now that you know the five building blocks, the next step is seeing them in action.

The following templates show how to apply this structure to common finance workflows so you can start using AI productively right away.

Ready-to-use finance prompt templates: One-off tasks

These are useful when you just need a fast answer without building a whole system. A well-structured one-off prompt saves time and avoids errors.

Template 1: Contract review for procurement

| Prompt Component | Details |

|---|---|

| Role | Procurement Specialist |

| Objective | Check a vendor contract for compliance with procurement standards |

| Context | Contract text plus procurement policy |

| Output format | Compliance status | Issues found | Recommended revisions |

| Constraints | Highlight any clauses that increase financial or compliance risk |

| Process | Review contract clauses against procurement policy; identify risks (financial, compliance, renewal terms); flag exceptions that require legal or leadership review; recommend: Approve, Reject, or Revise |

| Prompt example | "You are a procurement specialist. Review the attached vendor contract against our procurement policy. Provide results in the format: Compliance status | Issues found | Recommended revisions. Do not approve any contracts that include auto-renewal without termination clauses. Example of a compliant contract: Vendor B, one-year term, termination with 60 days’ notice." |

Template 2: Quick policy clarification

| Prompt Component | Details |

|---|---|

| Role | Finance controller |

| Objective | Check whether an expense, vendor, or contract complies with company policy |

| Context | Relevant policy document or excerpt |

| Output format | Approval status | Policy reference | Justification |

| Constraints | Only answer based on the policy text provided; no external assumptions |

| Process | Review the policy text; compare the specific clause, vendor, or expense against the rules; flag if it requires leadership review |

| Prompt example | "You are a finance controller. Review the attached procurement policy and tell me whether this vendor contract clause complies. Provide results in the format: Approval status | Policy reference | Justification. Only base your answer on the provided policy document." |

Ready-to-use finance prompt templates: Repetitive tasks

For tasks your team handles every week, like invoice approvals or compliance checks, it pays to separate instructions into system and user prompts.

- System prompt: The fixed context (policies, common exceptions to look out for, thresholds, roles).

- User prompt: The variable input (invoice, PO number, transaction details).

This structure ensures consistency, compliance, and outputs your team can trust.

Template 3: Invoice processing

| Prompt Component | Details |

|---|---|

| Role | Senior AP Specialist |

| Process | - Verify against PO [number]- Check payment terms compliance- Flag exceptions with details- Recommend: Approve, Reject, or Request clarification |

| System prompt | "You are a senior AP specialist tasked with processing invoices. Always review invoices against the corresponding purchase orders and our standard payment policy, which requires net-30 terms with a 2% early pay discount. Invoices over $10,000 require manager approval. Provide results in the format: Decision |

| User prompt | "Review the attached invoice against PO #4567 and vendor agreement." |

Template 4: Expense review

| Prompt Component | Details |

|---|---|

| Role | Finance Controller |

| Process | Review expense against procurement policy. Check budget allocation. Confirm approval workflow requirement. Flag exceptions requiring leadership sign-off. |

| System prompt | "You are a finance controller. Always evaluate expenses against company procurement policies and budget allocations. Flag any exceptions requiring additional approval. Provide results in the format: Approval status | Policy violations | Justification." |

| User prompt | "Evaluate this $2,847 software expense against our IT procurement policy." |

Template 5: Compliance check

| Prompt Component | Details |

|---|---|

| Role | Senior Accountant |

| Process | Categorize transactions using the chart of accounts. Apply SOX documentation checks consistently. Flag missing documentation. |

| System prompt | "You are a senior accountant. Always categorize transactions per our chart of accounts. Flag any transactions missing SOX documentation. Provide results in the format: Transaction ID | Account code | Justification | SOX documentation flag. Example of compliant entry: ID 23456, Account 5010, justified as office supplies, documentation complete." |

| User prompt | "Categorize these transactions per the attached chart of accounts." |

These templates give you a head start, but the real value comes from adapting them to your policies and workflows.

| 💡 Want these templates in a one-pager you can use right away? Get the Google Doc version here and save a copy to your Drive. |

|---|

Even with good templates in hand, it is easy to slip into patterns that make AI outputs unreliable.

Let’s look at the most common mistakes finance teams make and how to correct them with small but powerful changes.

Troubleshooting your finance prompts

Most prompt failures in finance trace back to two issues: weak one-off prompts, or treating repetitive tasks like one-offs instead of setting up system and user prompts.

This section focuses on the first problem.

1. Vague instructions

Problem: The prompt asks AI to “analyze” or “review” without saying what to check.

Fix: Spell out the specific checks you want performed.

| Before “Analyze this invoice.” | After “Review this invoice against PO #12345. Flag discrepancies in pricing, quantities, delivery dates, and payment terms.” |

|---|

2. Missing business context

Problem: AI has no knowledge of your policies or thresholds unless you provide them.

Fix: Include the relevant policies and approval rules in the prompt.

| Before “Is this expense reasonable?” | After “Evaluate this $2,847 software expense against our IT procurement policy (attached). Consider budget allocation, approval workflow, and vendor status.” |

|---|

3. No output structure

Problem: Free-form text is unusable in finance workflows

Fix: Define the format you expect

| Before “Summarize our cash position.” | After “Cash position summary format: Current balance | Projected 30-day inflows | Committed outflows | Net position | Liquidity risks requiring attention.” |

|---|

4. Ignoring compliance checks

Problem: Prompts that skip compliance rules create outputs you cannot audit.

Fix: Build compliance into the instructions.

| Before “Categorize these transactions.” | After “Categorize per the chart of accounts (attached). Flag any requiring additional SOX documentation. Include account codes and justification for each category.” |

|---|

Most one-off issues can be solved with these quick fixes. But when the task is repetitive, the bigger gains come from system and user prompts that deliver consistent, auditable outputs.

Advanced prompting techniques for finance

You saw in the template section on repetitive tasks how system and user prompts work in practice.

Here, we’ll take a closer look at why this structure matters and how it fits into what’s becoming known as context engineering.

System and user prompts (context engineering)

What it is: For repetitive tasks, split your instructions into two parts:

- System prompt: The fixed rules, policies, and context the AI should always follow. For best results, include examples of right and wrong, call out common edge cases and how to handle them, and specify cases that require escalation.

- User prompt: The specific instructions and input data/documents for the current task, such as an invoice, contract, or transaction history CSV.

You may have seen this in practice with the Projects feature in ChatGPT (or the equivalent in Claude).

Uploading documents or setting rules in a project creates a system prompt, a persistent set of instructions and context the AI carries across sessions. Each new question inside that project is the user prompt.

Why it matters: This structure ensures more accurate, consistent and auditable outputs over time.

Think of it as the difference between asking a random accountant on the internet for advice versus asking your company’s controller, who already knows your policies. By giving AI the right context, you get answers you can actually trust.

And similar to prompt engineering, effective context engineering is predicated on iteration. You’ll need to refine the context you provide in the system prompt through iterative testing against evals.

(Check out Building Reliable AI for Finance and Operations: A Tested Approach to go deeper!)

Example approach:

- System prompt: “You are a senior AP specialist. Invoices must be reviewed against corresponding purchase orders and vendor contracts to ensure pricing and payment terms are compliant.

The attached approved and rejected invoices from the past (with filenames ending with “_approved” and “_rejected”, respectively) are examples for reference.

Watch out for invoices with due dates less than 5 days in the future, flagging them as requiring escalation.” - User prompt: “Review the attached invoice, purchase order and vendor agreement, and determine whether the invoice should be approved or not. Assign a confidence score between 0-1, and provide a short explanation for your decision and confidence score.”

This practice is sometimes called context engineering. It is still new in technical circles, but for finance teams, it simply means giving the AI the background it needs to act like it understands your business.

Role-based prompting

What it is: Tell AI to act as if it holds a specific finance role with defined responsibilities.

Why it matters: This gives the model a frame of reference. Instead of guessing how a generic “assistant” might respond, it answers as a controller, AP specialist, or auditor who is trained to follow certain rules.

Example prompt:

“You are a controller with 15 years of experience. Review these journal entries for compliance with our chart of accounts. Flag any entries that violate SOX controls and explain why.”

Iterative testing

What it is: Run your prompts on historical data where you already know the correct outcome.

Why it matters: This lets you measure accuracy, identify weak spots, and refine the prompt before deploying it in live processes.

Example approach:

- Start with one use case, such as expense categorization.

- Feed in a batch of historical expenses and compare AI’s output to the official records.

- Tweak the prompt until the results consistently align with the right answers.

Together, system/user prompts, role-based prompting, and iterative testing help finance teams move from “one-off experiments” to a more reliable and systematic approach to prompting.

4 guardrails for finance prompting

Every finance prompt should meet these four standards. Treat them as non-negotiables:

- Accuracy: Instructions must be precise. Even small errors can cascade into compliance violations or misstated reports.

- Compliance: Outputs must be explainable and auditable. If you cannot trace why AI produced an answer, it is unusable.

- Context: Include the policies, thresholds, and business rules that shape the decision. Without them, the AI is guessing.

- Format: Define the exact structure you need so results plug into your ERP, reporting, or approval workflows without manual cleanup.

Keep these guardrails front and center as you refine prompts. The real breakthrough comes when your whole team shares and reuses them, turning individual wins into a consistent prompt library everyone can rely on.

Building your finance prompt library

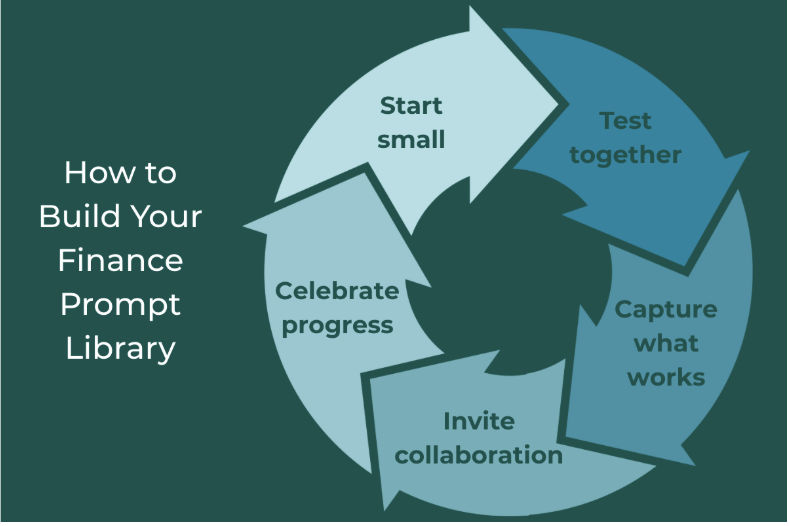

Mastering individual prompts is a big step forward. The real breakthrough comes when your whole team can rely on them. Adoption across an organization is never instant, but it does not have to be intimidating.

A shared prompt library makes it easier to spread what works, build confidence, and give everyone a head start.

Think of it as turning one person’s quick win into a collective skill. When finance teams share prompts, they share confidence. Instead of scattered experiments, you get consistency, trust, and results that scale.

How to start a prompt library

-

Start small

Choose one repetitive task the team handles every week, like invoice reviews or expense categorizations, and document the prompt that works. -

Test and validate

Run prompts against historical data where the right outcome has already been validated. This keeps adoption safe while proving value quickly. -

Capture what works

Save successful prompts in a shared space with clear objectives, context, and output formats. Make them easy for others to use right away. -

Invite collaboration

Encourage colleagues to refine prompts and add their own. The more people contribute, the stronger the library becomes. -

Celebrate progress

Track accuracy gains and time saved, and share those wins. Momentum grows fastest when people see the benefits spreading across the team.

Building a library is about more than saving prompts for convenience’s sake. It’s about encouraging the collaborative learning required to build confidence in AI across your team and organization.

While a strong prompt library can take you far, there are moments when prompting alone cannot handle the complexity. That is when it is time to look at the next level of automation.

When prompting is not enough

Even the best prompts have limits. Some finance tasks involve too many moving parts to handle with instructions alone. Knowing where those boundaries lie helps you decide when to keep refining a prompt and when to move up to more sophisticated automation.

Multi-step workflows

Tasks that span multiple systems or approvals, such as three-way invoice matching, require coordination across steps. A single prompt cannot orchestrate that sequence reliably.

Complex exception handling

Processes with many conditional paths quickly outgrow what prompting can manage. Every “if this, then that” layer makes it harder for AI to stay accurate without automation in the background.

Real-time requirements

If a workflow requires immediate responses, such as fraud checks or instant approvals, prompting alone is too slow or inconsistent.

High volume processing

Hundreds of transactions per day demand scale. Prompts can prove the concept, but an agent-based system is needed to handle throughput without human bottlenecks.

This is where agent-based automation comes in. It extends the same principles of clear objectives, context, and constraints, but embeds them inside systems designed to run at scale.

Prompts are the foundation. Automation is how you build on top of them.

To get there, the best way to begin is by putting your first prompt into practice and building momentum from that initial win.

Over to you: Your first finance prompt

You don’t need to overhaul entire processes to see results. The easiest way to begin is with a single prompt that solves a recurring task. That first win builds confidence and creates momentum for broader adoption.

How to start

-

Pick one recurring task

Choose something your team handles every week, such as invoice review, expense categorization, or compliance checks. -

Write your prompt

Use the five-component anatomy: objective, context, output format, constraints, and examples. -

Test it safely

Run the prompt against historical data where you already know the right answers. -

Refine and improve

Adjust based on results until the output matches what you expect. -

Share with colleagues

Add it to your team’s prompt library so everyone can benefit and build on it.

Good prompting is not about perfection on day one. It is about creating a foundation of small, reliable wins that compound over time.

You don’t have to figure this out alone.

Reach out today to learn how CoPlane can help turn your team’s repetitive, manual procedures into autonomous business processes.